Morgan Stanley's $27M Gorman Payout: A Deep Dive into CEO Compensation

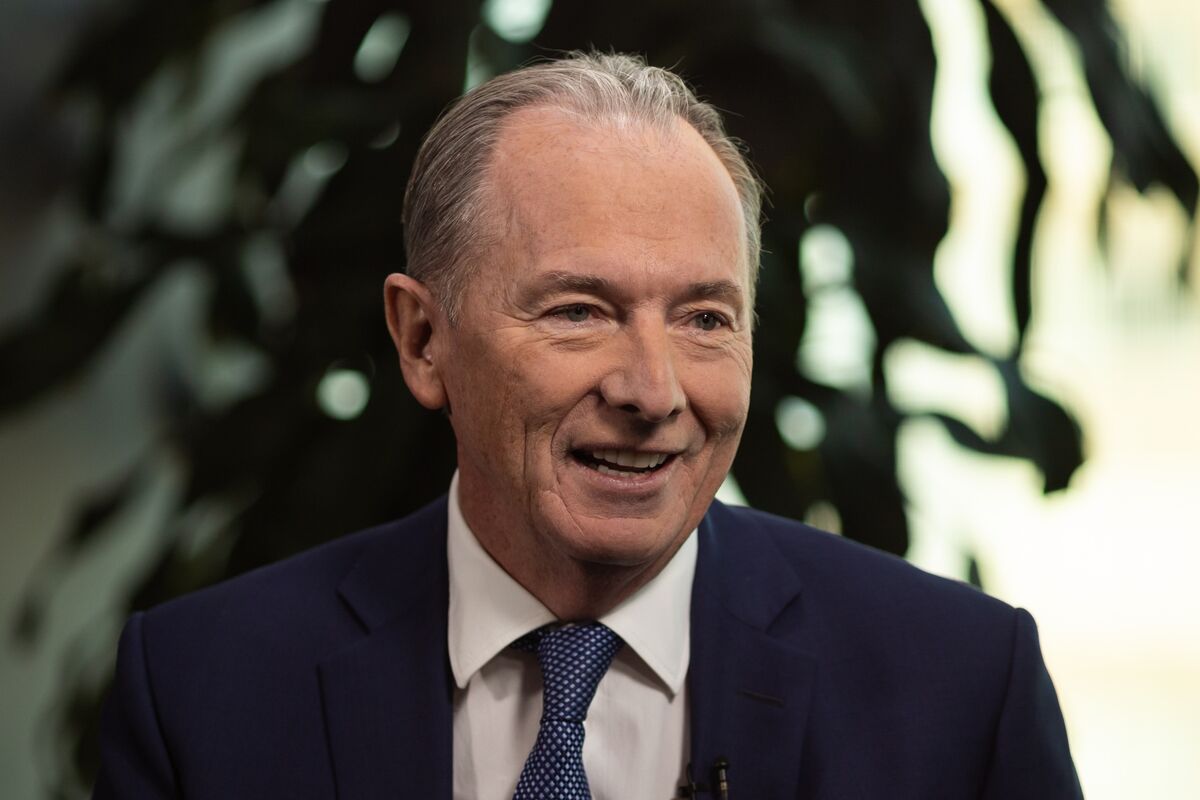

Editor’s Note: Morgan Stanley's disclosure of CEO James Gorman's $27 million compensation package has sparked debate. This article delves into the details, exploring the justification, criticisms, and broader implications.

Why This Matters

Morgan Stanley's CEO compensation announcement isn't just another corporate disclosure; it's a microcosm of the larger conversation surrounding executive pay, particularly in the financial sector. The sheer magnitude of the payout – $27 million for James Gorman – raises questions about fairness, shareholder value, and the ethical considerations of rewarding top executives in an industry often criticized for its role in economic inequality. This article will examine the components of Gorman's compensation, compare it to industry peers, and analyze the arguments both for and against its justification. We'll also explore the potential impact on investor sentiment and employee morale. Keywords: James Gorman, Morgan Stanley, CEO compensation, executive pay, financial sector, shareholder value, corporate governance.

Key Takeaways

| Aspect | Detail |

|---|---|

| Total Compensation | $27 million |

| Salary | [Insert Specific Salary Amount if available] |

| Bonus | [Insert Specific Bonus Amount if available] |

| Stock Awards | [Insert Specific Stock Award Amount if available] |

| Performance Metrics | [List key performance indicators used to determine compensation] |

| Controversy | Public debate regarding the fairness and size of the payout |

Morgan Stanley's $27M Gorman Payout

The disclosure of James Gorman's $27 million compensation package has ignited a firestorm of discussion. While Morgan Stanley highlights strong financial performance under Gorman's leadership as justification, critics argue the payout is excessive, especially in the context of rising inflation and economic uncertainty impacting average employees. This substantial reward underscores the complexities of executive compensation in a globalized financial landscape.

Key Aspects of the Payout

The $27 million figure likely comprises a base salary, performance-based bonuses tied to specific financial targets (like return on equity, revenue growth, or market share), and stock awards designed to incentivize long-term growth. A detailed breakdown, if publicly available, would provide further insight into the precise weighting of each component.

Detailed Analysis

A comprehensive analysis requires comparing Gorman's compensation to that of CEOs at other major financial institutions. Is his package significantly higher or lower than industry averages? Moreover, evaluating the specific metrics used to determine his bonus and stock awards is crucial. Were these targets ambitious and challenging, or easily achievable, potentially signaling a disconnect between executive compensation and true performance? Finally, the long-term impact on shareholder value needs consideration. Did the significant growth under Gorman's tenure justify this substantial payout, or could it have been achieved with a more moderate compensation structure?

Interactive Elements

Gorman's Leadership and Morgan Stanley's Performance

Morgan Stanley’s success under Gorman’s leadership is undeniable, including navigating several significant financial crises. This section would analyze specific achievements, quantifying their impact on the company's financial health and market position. Relevant metrics include revenue growth, profitability, stock price performance, and market share data. This objective data provides context for assessing whether Gorman's compensation aligns with his contributions.

Shareholder Activism and Public Opinion

This section would address the potential for shareholder activism related to the compensation package. Are shareholders likely to challenge the board's decision? What is the public reaction to the news, considering the broader societal context of income inequality and executive pay? Analysis of social media sentiment and press coverage would be valuable here.

People Also Ask (NLP-Friendly Answers)

Q1: What is Morgan Stanley's $27M Gorman Payout?

A: It refers to the total compensation package received by Morgan Stanley CEO James Gorman, amounting to $27 million, comprising salary, bonus, and stock awards.

Q2: Why is this payout important?

A: It highlights the ongoing debate regarding executive compensation in the financial industry, raising questions about fairness, shareholder value, and the ethical implications of high executive pay in a time of economic uncertainty.

Q3: How can this affect Morgan Stanley's reputation?

A: It could negatively impact Morgan Stanley's public image, especially considering public sensitivity towards income inequality. It could also affect investor sentiment and employee morale.

Q4: What are the main challenges with such high executive pay?

A: Challenges include justifying the payout to shareholders and employees, potential negative public perception, and concerns about the fairness of the distribution of wealth.

Q5: How does Gorman's pay compare to other CEOs?

A: A comparison with compensation packages of CEOs at peer financial institutions is needed to determine if it is above or below average. This would provide valuable context.

Practical Tips for Understanding CEO Compensation

Introduction: Understanding executive compensation can be complex. These tips will help you critically assess such disclosures and engage in informed discussions.

Tips:

- Look beyond the headline number: Examine the breakdown of salary, bonus, and stock awards.

- Compare to peers: Assess the compensation relative to similar companies and industry averages.

- Analyze performance metrics: Examine the criteria used to determine the bonus and stock awards.

- Consider long-term value creation: Evaluate the CEO's impact on shareholder value over a longer timeframe.

- Read the proxy statement: This document contains detailed information about executive compensation.

- Follow financial news: Stay updated on industry trends and discussions regarding CEO pay.

- Engage with companies: Contact investor relations to ask questions about compensation decisions.

- Understand the regulatory framework: Familiarize yourself with relevant regulations and guidelines.

Summary: These practical tips help navigate the complexities of understanding CEO compensation packages.

Transition: Let's now summarize the key takeaways from our analysis of James Gorman's compensation.

Summary

James Gorman's $27 million compensation package at Morgan Stanley has sparked important discussions about executive pay, fairness, and the role of corporate governance. While Morgan Stanley highlights its strong performance under Gorman's leadership, critics question the magnitude of the payout. A deeper dive into the specific performance metrics used to justify the compensation, alongside a comparison to industry peers, is necessary for a comprehensive evaluation.

Closing Message

The debate surrounding executive compensation is far from settled. It's a complex issue with significant ethical, economic, and social implications. This analysis serves as a starting point for critical evaluation, urging readers to examine future disclosures with greater scrutiny.

Call to Action (CTA)

Share your thoughts on this topic! Join the conversation on social media using #MorganStanleyPay and #CEOCompensation. Subscribe to our newsletter for more in-depth analyses of corporate finance and governance.